The Best Way to Create an Emergency Fund: Money 911

An emergency fund can help you deal with unexpected expenses. Dealing with these items, such as medical emergencies or car repairs, is never fun. Without an emergency fund, these unplanned expenses can turn into a financial disaster. About 4 in 10 adults can’t afford to pay for an unexpected expense without borrowing money or selling belongings.

What would you do if your transmission in your car stopped working or your AC unit died? This is why it’s important to start working toward building an emergency fund.

Understanding an Emergency Fund

A banking institution doesn’t have an account that can be labeled an emergency fund. Instead, the responsibility will fall on an individual to set up an account and be sure to earmark its use for emergency cash only. While at some point you may be able to invest some of your funds, you don’t want to do so initially. You want to make sure that money is liquid so that you can actually access it in the event you need to for an emergency.

The Benefits of an Emergency Fund

Many financial experts will recommend that you have three to six months of household expenses away in a bank account to cover unexpected situations such as injury or illness, job loss, reduction in income, auto or home repairs, and unplanned travel expenses. In addition to making sure you are prepared for unexpected expenses, an emergency fund can help in other ways.

Keeps Stress Levels Down

When life presents you with an emergency, it can threaten your financial well being and this can cause a lot of stress. If you don’t have a safety net then you are on living on the financial edge and must hope you don’t ever run into a crisis. By being prepared with an emergency fund, it will give you the confidence to tackle anything that is unexpected without adding money worries to your list of things to stress about.

Protect Your Credit Score and Report

Financial surprises can often hurt your credit score. If you are sick or out of work, aren’t paying your bills, and don’t have a financial cushion to rely on then it’s not hard to see how this can play a big role in your credit report and score. If you are falling apart in your credit obligations then it will have an impact on your score. This impact can stay on your credit score for years.

Late payments can stay on a credit report for up to seven years. Relying on credit cards during this time can also hurt you. Using more of your credit limit will show on your credit report and your utilization ratio will increase. How much credit you are using in comparison with your credit limit will have an impact on your score. Having an emergency fund can help you avoid running up a high credit card balance and prevent this issue.

Can Help You Avoid Unusually Expensive Debt

When you don’t have this money set aside to use then you can be forced to look at other ways to pay for unexpected expenses. This can include taking out a loan, turning to a payday lender, or using a credit card. Credit cards can have high interest fees but payday loans can be dangerous. It can be the most expensive debt you will ever have. When you consider the high costs of borrowing money, you may want to have some set aside in advance.

How to Build an Emergency Fund

Building an emergency fund doesn’t have to be complicated if you know how to do it. There are plenty of strategies to save money with bad credit. Specific methods you use can depend on your personal situation, including current debts, income, and other financial responsibilities.

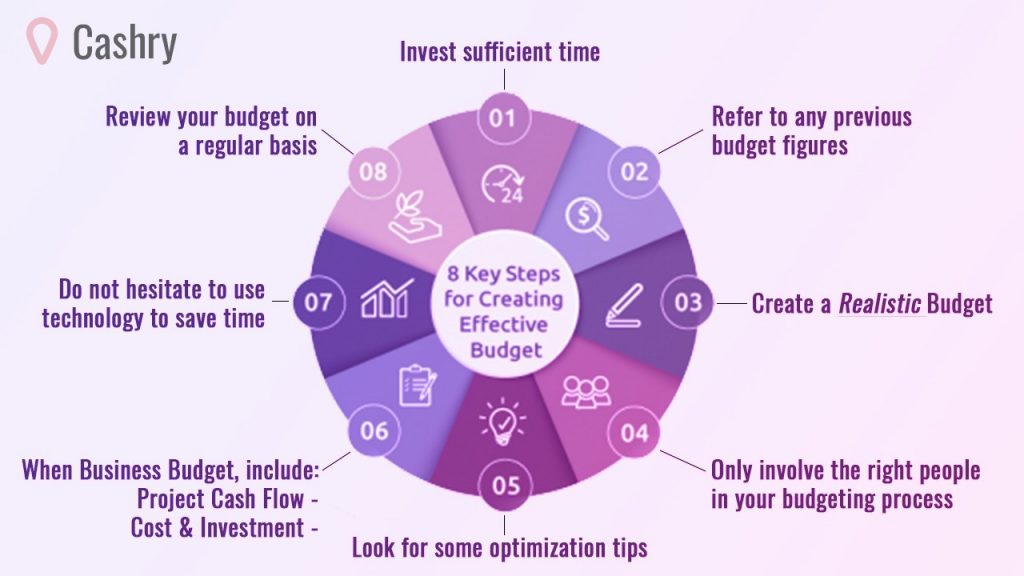

Make a Budget:

Start off by making a budget and listing all of your income and expenses. When you make this budget, you will be able to see how much money you have available to put toward your savings goals.

Start Small:

The eventual goal can be to keep three to six months of expenses or more, given how expensive emergencies can be, but it’s important to start small with a more realistic goal so you don’t become overwhelmed. Take a look at your budget and see how much you can afford to save each paycheck.

Automate Savings:

Once you have figured out how much money you can put into an emergency fund each month, then consider automating your savings. You can set up an automatic transfer of any amount that will work for your budget into your fund. Your credit union or bank can already have this feature available. It’s wise to set up a new savings account that is separate from the account you pay your bills from for an emergency fund. This way it is out of sight and out of mind. Online banks may also be a good option for this since they may offer high savings interest and lower fees than traditional banks. When you keep the money for an emergency fund in a separate account you can be less tempted to spend the money.

Supercharge Savings:

If you want to build a fund quicker then you may be able to supercharge your savings by cutting some of your expenses. If you can reduce your monthly spending by lowering grocery bills or eating out less often then you have more money to funnel into your emergency fund. Another good way to save money is by checking for lower insurance rates and asking service providers if they are able to give you a better deal. You can also help grow your fund by earning extra money on the side. Pick up a side gig, even temporarily, or sell unwanted items to reach financial goals even faster.

Track Your Progress:

It will take time to build your fund and, in order to not get discouraged, you can celebrate small successes along the way. If you have given up eating out in order to build your emergency fund quicker then treat yourself to a meal out once you have saved a full month of expenses. You don’t have to give up everything in order to make your savings goals. You likely just need to be more thoughtful about spending habits. As time goes on and you are tracking your progress, you may find that you will be able to save even more. If you or your spouse gets a promotion at work, add that into your emergency fund instead of spending more on your lifestyle. Keep looking over your budget in order to find new ways to cut back on expenses and increase the amount you are saving.

When Should You Use Your Emergency Fund?

The obvious answer is to use your fund when you have an actual emergency, but what constitutes an emergency? It’s important to note the distinction between an emergency fund and a savings account. Your emergency fund is money you have saved for an unexpected cost that could otherwise blow your budget, such as a trip to the emergency room. Your savings account is the money you have been saving for future purchases like an anniversary vacation. However, not every expense is going to be as clear-cut. There are some questions you can ask yourself in order to determine if it is best to use your emergency fund.

Is it Unexpected?

Life can have a few surprises, include a job layoff. With an unexpected surprise, you should use your emergency fund in order to put food on the table and stay in your home. If there is a disaster in your neighborhood, such as a tornado or a storm, then you can use your rainy day stash to cover expenses that your insurance doesn’t cover. Annual recurring expenses don’t qualify as an emergency. In order to not be caught off guard by holiday gifts or back to school shopping, be sure to put a little bit each month into your savings account so you can enjoy these occasions but not dive into your emergency fund.

Is it Necessary?

Necessities can sometimes be confused with wants, but they are actually two separate things. If your car breaks down and it’s the only way you can get to work then you need to get it fixed. If your HVAC breaks down in the middle of the summer then you need to get it fixed. These are emergencies. However, if you want to upgrade your kitchen countertops or want the newest cell phone these are wants and not necessary. If your kitchen is functional and your phone still works then upgrades aren’t necessary. While new stuff is great, don’t use money for your needs to pay for stuff you want.

Is it Urgent?

There are some things that require immediate money, such as your child needing stitches. However, if your dishwasher is on the fritz then replacing it isn’t as urgent. If you know you will need to replace it soon then start putting money aside for it so when it does give out, you have money for a new one and don’t have to tap into your fund.

Remember if you have to use the money it’s okay. Your emergency fund may just feel like a ton of money that is doing nothing just sitting there but it’s actually helping you a lot. Think of it as an insurance policy against the unpredictable things in life. It’s not supposed to be drained because there is something new and shiny. If you do use your account, be sure to replenish the savings as soon as you get back on your feet since you never know when you will need that money again.

Where Should You Keep Your Emergency Fund?

Now that you know the benefits of an emergency fund and ways to start one, you also need to know where you should keep it. You want to make sure that your emergency fund is parked in a safe spot and you are getting a return. The cash will need to be readily accessible in case you need it.

High Yield Bank Accounts

A high yield savings account can be one of the best places to store your emergency fund. Not only will your funds be easily accessible but you will also get interest on your deposits. In order to find the right one, search for ones with a competitive interest rate and no balance requirements or monthly fees.

Money Market Accounts

If you are trying to invest your emergency fund then consider money market accounts. These are similar to savings accounts and can give higher yields. You can open this type of account at a local bank or online and then be able to access your money through the web-based management of the account. Your funds can be withdrawn at any time. However, it’s important to note that the fees could chip away at some of your savings.

Certificates of Deposit

CDs will offer a fixed rate of return if your money is kept for a specific length of time. Since the rate of your return is guaranteed then opening this account can be a way to get some extra interest for your emergency fund. However, these accounts will tie up your money so it’s not as easily accessible. You may have a penalty if you close your account early to get your funds. Some people will open up multiple CDs with different maturity dates so cash will be available at all times in the event of an emergency.

Roth IRA

If you invest your funds conservatively then you may be able to get higher earnings than with a traditional savings account and not have as much risk. However, if you keep your emergency funds here, remember that your Roth IRA could lose value.

Your emergency fund is there to protect you from unexpected expenses. When you aren’t using it, it still needs a safe place to grow.

How Much Should You Have in Your Emergency Fund?

It’s recommended to set aside three to six months of your take-home pay for an emergency. This can feel like a big number when you are first starting out. However, this emergency fund is one of the most important things you can do with your money. There are different factors that come into play that will determine how much you actually need in your emergency fund. The more uncertainty you have in your financial life, then the larger you want your emergency fund to be.

If you own a fixer upper or you freelance full time then you want to have more than six months of salary saved up. If you have a steady salaried job or share finances with someone, or don’t have a mortgage or dependents, then three months is a fine option. It will also depend on your personal comfort level. If you have a stable job and three months still doesn’t provide you with financial security then you should save more. These are just guidelines and you should do what feels the most comfortable for you. You don’t want to keep all your money in cash and possibly diversify your emergency fund.

What to Do When You Need Help Paying Bills

It can be hard to build up an emergency fund if you already need help paying your bills. If you need help with bills and to save money with bad credit, there can be options available to you.

Help Paying Rent

If you find yourself not sure where your next rent check is coming from then there are places that will help with rent and other living expenses. This can be in the form of your local state rental help programs. Regardless of the major U.S. city you live close to, these types of programs, called rental assistance programs, can be spread out. All states have these. You will have to do some research in finding one but your local city and county will be able to help you to find the one nearest you.

These programs can help people with any back rent that is due in order to prevent the process of eviction. Certain programs may even offer assistance with a security deposit. It doesn’t hurt to try if you have nowhere else to go. There will be eligibility requirements for these assistance programs and assistance can be limited.

Help Paying Utility Bills

Money to help with paying bills does exist and there are usually no strings attached. Section 8 programs can be types of special assistance to get you set up in the right direction. For help with food costs, there is the Supplemental Nutrition Assistance Program (SNAP) to provide eligible people with debit cards to buy food at authorized grocery stores. For healthcare costs, Medicaid can provide free or low-cost health benefits for certain people. There is also the Children’s Health Insurance Program (CHIP) for uninsured children. All programs do have limits and many programs require you to be a U.S. citizen. Some programs have state requirements, such as family size.

Help with Debt

There are ways to get a hold of your debt. There are plenty of debt solutions that are made to help many people in the long run.

Can Debt Consolidation Help with an Emergency Fund?

While many people try to avoid debt, it can be an unavoidable part of life. Having debt can make it hard to build up an emergency fund. However, debt is not always a bad thing as long as you take on debt intentionally. If you do have bad credit, there are also bad credit savings tips that you can use, including debt consolidation, to help improve your fund. Sometimes a person’s debt can get so out of control that they have several credit cards and can’t keep track of payment schedules. This makes building an emergency fund nearly impossible so debt consolidation may be able to help.

Debt consolidation will roll multiple debts into one single payment. This way you don’t have to keep track of several accounts and worry about missing payments. You may also get a better interest rate so it can be cheaper in the long run. Your credit score will be a deciding factor in determining whether you can qualify for a debt consolidation loan. Those with bad credit will have to pay more interest and it may make debt consolidation not worth it.

Debt Consolidation Products

There are different debt consolidation products available in order for you to consolidate your debt. Often it’s best to get a loan to pay off debt if you want to reduce your overall interest payments over the long run.

Consolidation Loans for Bad Credit

Many modern lenders will be able to offer debt consolidation loans even if you have bad credit online in a short period of time. If you need help paying your bills and are short on time, this can be a good option. Just log on and apply in your spare time. This way you don’t have to spend time visiting different lenders to find the best ones in town.

Consolidation Personal Installment Loans

The benefit of personal installment loans for consolidation is that it will take the worry out of dealing with different financial institutions that are hounding you for monthly payments. For those who are short on cash or have damaged credit, a personal installment loan can be a good option.

Your first step of getting out of debt and paying off what you owe should be to take the time to organize your finances and cut possible expenses. When you do choose a loan, it’s important to consider your options carefully and don’t just take the first loan that is available to you. Shop around to get the best terms, rates, and conditions.

What Should You Do if Your Emergency Fund Isn’t Enough?

If the cost of your emergency is bigger than your emergency fund, there are a few things you can do.

Call and Negotiate a Payment Plan

Depending on your emergency, you may be able to negotiate a payment plan. If your emergency is medical, you can call the billing department at the hospital and ask about a payment plan for medical expenses. Be patient, kind, and persistent. If you pay something up front it will show you are serious about repaying the debt and they will likely work with you.

Shop Around

If you need car repairs or repairs for something in your home, it will help to shop around. Ask family and friends for reliable recommendations and call about any deals or specials. If the price is more than you can afford, ask about the bare minimum fix until you can pay for the full repair.

Make Extra Money Quickly

Sometimes you just need more cash. You can sell things you don’t use anymore for quick cash. If you still need some more quick cash, you can consider making budget cuts and say goodbye to cable, an expensive cell phone plan, shopping money, and restaurants. These temporary cuts can add up to some big savings. You can also add some more money by working freelance, delivering groceries, dog sitting, or working overtime at work if it’s available.

Money Tips for Millennials

People of different ages view money differently. Learning how to manage money can come with age but that isn’t always the case. Factors such as how you were raised can also play into money spending habits. Millennials have grown up in a technologically advanced age and they are more analytic in how they process everything, including money.

In general, millennials have less money than previous generations due to the rising costs of college and have a significant amount of student loan debt. They are also making less money out of college than previous generations. However, millennials have better budgeting skills overall as more schools are stepping up to teach children real-life skills. There are also plenty of financial apps that can make managing money simple. There are budgeting tools and ways to calculate net worth using apps. No matter what millennials are doing to save money, and even if they are budgeting better than previous generations, saving for a rainy day or having an emergency fund is just as important.

In Conclusion

Having an emergency fund can give you a number of different benefits. When you are working toward building an emergency fund, it helps to start small and slowly work your way up to having the optimal amount that makes you comfortable for your unique situation. It’s important to note what constitutes a real emergency, so you aren’t using your fund for just about anything. Your fund shouldn’t just be for paying your bills and if you are having trouble paying your bills, there may be some options available to you. Debt consolidation may also be a way to help you so you can build up more for your fund. Millennials, just like any other generation, also need access to a fund since emergencies can happen at any age.

Kevin Strauss is a personal finance writer and homeowner based in the Los Angeles area. Being in one of the most expensive markets in the country, he’s learned to maximize resources to plan for both his monthly expenses and future financial needs. Kevin has a passion for helping those in a similar situation navigate the complex world of personal finance so they can pay down debt, plan for the future and live out their dreams. In addition to covering personal finance in depth on Loanry.com and Cashry.com, Kevin shares his expertise with readers who want to create budget-friendly habits across the web.